1. Construction: The Current Picture

The construction industry is important to the Scottish economy, providing work in every community and plays a vital role supporting communities and society by building schools, homes, hospitals, offices and other vital infrastructure, supporting every sector of the economy. Understanding, supporting and transforming the construction industry in Scotland will be essential to meet Scotland’s economic and social ambitions, including the transition to a net zero economy and becoming a Fair Work Nation by 2025.

1.1 The Economic Contribution of the Construction Industry in Scotland[29]

The construction industry is very valuable for the Scottish economy. Prior to the COVID-19 pandemic, in 2019 the construction industry generated 11% of Scotland’s economic output.[30] Research commissioned by Construction Scotland in 2020 estimates that for every £1 spent on construction output a further £2.94 is generated in the economy while construction exports were worth £125 million, 0.4% of Scotland’s total international exports.[31]

The industry is diverse with a range of sub-sectors, but splits mainly into the construction and repair of buildings, civil engineering and specialised construction activities. Building construction has the highest turnover, while specialised activities accounts for the greatest share of employment.[32]

Comparing the structure of the construction industry in Scotland to the UK highlights that infrastructure spending is particularly important within Scotland, accounting for over a fifth of work, compared to a UK figure of 14%. Scotland also has a higher level of public housing output (7%) compared to the UK (3%).[33] These figures highlight the importance of public spending and the role it can play in shaping the industry in Scotland.

In 2020, total employment in construction in Scotland was 130,000 (5.1% of all jobs).[34] By comparison, construction accounts for 4.9% of all jobs across Great Britain. This figure includes all workers paid directly from the businesses' payroll(s), and does not include any agency workers paid directly from an agency payroll.

23.5% of people working in the construction industry were self-employed, compared with 11.6% for Scotland as a whole. 76.5% of people working in construction were employees.[35] These figures are derived from the Annual Population Survey and the split between employees and self-employed is based on the survey respondent’s own assessment of their employment status.

The volatile nature of the industry and instability in the supply chain has led to insolvency for some large main contractors, the consequences of which have been catastrophic, with widespread job loss and a negative economic impact on businesses further down the supply chain[36]. Construction leads the top 10 UK industries in terms of number of insolvencies, with 3,202 in 2018.[37]

A key feature of the construction industry is long and complex supply chains. The industry is marked by large contractors who operate a hollowed-out model, employing relatively small numbers of people directly, instead acting as procurement or contract managers and relying on a range of subcontractors. Subcontractors are usually smaller, often specialist, businesses, and play a key role in the industry in terms of employment and training. Agency workers and workers employed by umbrella companies provide additional labour to supplement a declining directly employed workforce. Improving fair work in all parts of this supply chain will be key to delivering positive outcomes for workers in the industry.

1.1.1 Characteristics of the Industry

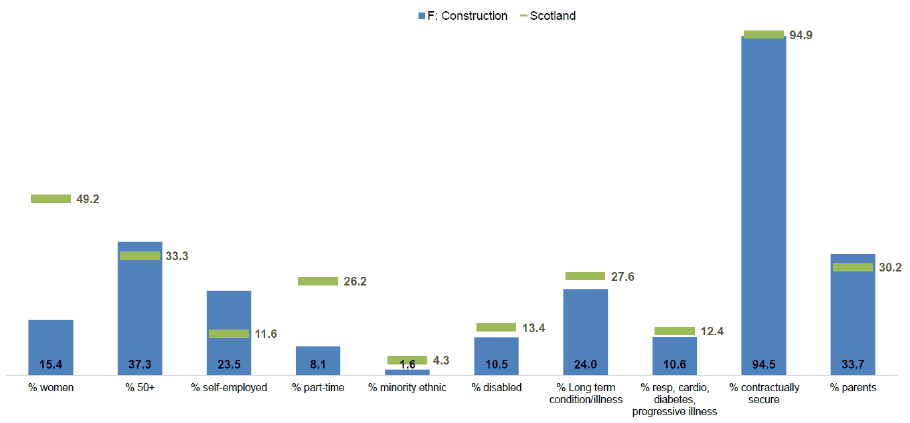

In the construction industry in Scotland in 2020:

- 84.6% of workers were men and 15.4% were women.

- 37.3% of workers were over 50 years old compared with 33.3% for Scotland as a whole.

- 67.7% of the construction workforce were 35 years old or older; which was older than Scotland’s workforce overall, where 65.1% of the workforce are in this age range.

- 1.6% of workers in the construction industry were from a minority ethnic background compared with 4.3% of minority ethnic workers in Scotland as a whole.

- 10.5% of workers in the construction industry were disabled compared with 13.4% for Scotland as a whole.

- 33.7% of workers in the construction industry were parents of children aged 16 or younger, compared with 30.2% for Scotland as a whole.

- 6.0% of employees in the construction industry were women with dependent children (aged 0-16), compared with 15.4% for Scotland as a whole.

- 5.9% of workers in the construction industry were non-UK nationals compared with 9.2% for Scotland as a whole.

- 94.5% of employees in construction aged 18+ had a permanent contract, lower than for Scotland overall (94.9%).

- 8.1% of those working in the construction industry worked part-time, compared with 26.2% for Scotland as a whole.[38]

Source: ONS, Annual Population Survey: Jan-Dec 2020.

1.1.2 Impact of COVID-19

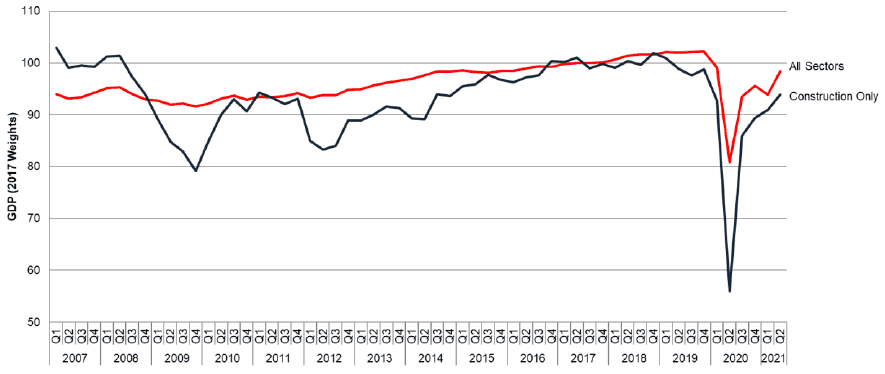

The construction industry has faced a range of challenges as a result of the COVID-19 pandemic - in the second quarter of 2020 construction was largely shut down in Scotland for all but essential projects. The industry now shows signs of recovery.

Source: Scottish Government

Output in Scotland’s construction sector expanded by 3.3% in 2021 Q2 compared to the previous quarter. On an annual basis, output in the construction sector expanded by 67.8% comparing the latest quarter (2021 Q2) with the same quarter a year previously (2020 Q2) – note that this significant increase reflects the impact of the COVID-19 pandemic and the ensuing national lockdown in Spring 2020.[39]

In 2021 Q2, the output of the Scottish economy as a whole expanded by 4.7% compared with the previous quarter (2021 Q1). On an annual basis, comparing the latest quarter (2021 Q2) with the same quarter a year previously (2020 Q2), the economy expanded by 21.7%.[40]

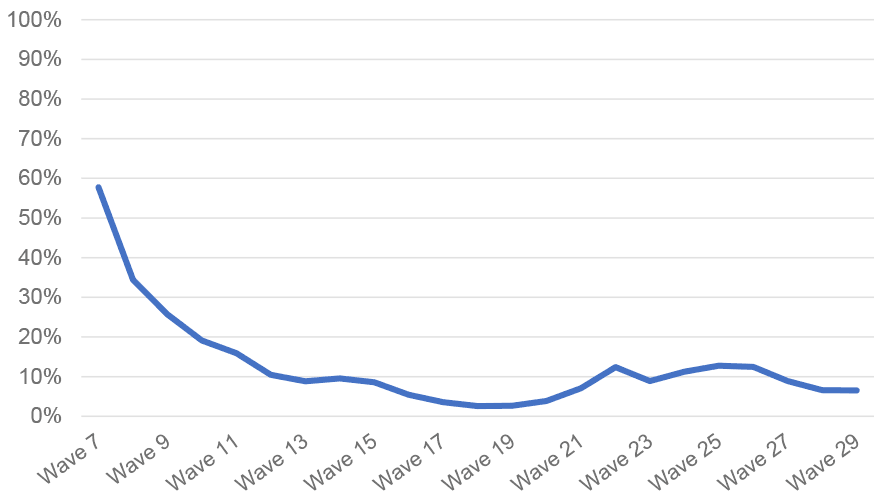

In the early stages of the pandemic, a significant proportion of workers in the construction industry in Scotland were on furlough – almost 60% of workers in June 2020 (Wave 7). Following this period, and as restrictions were relaxed, the proportion of workers on furlough leave fell considerably. There was a spike in December 2020 (Waves 21 and 22) and moving into the first quarter of 2021 (when approximately 10% of workers were on furlough), with levels subsequently falling once more.[41]The construction industry also accounts for the highest numbers of claims under the Self-Employment Income Support Scheme. A quarter of all claims made under the scheme to June 2021 came from self-employed workers in construction in Scotland, significantly higher than the next highest industry, transport and storage (12%).[42]

Source: ONS - BICS, Scotland Estimates

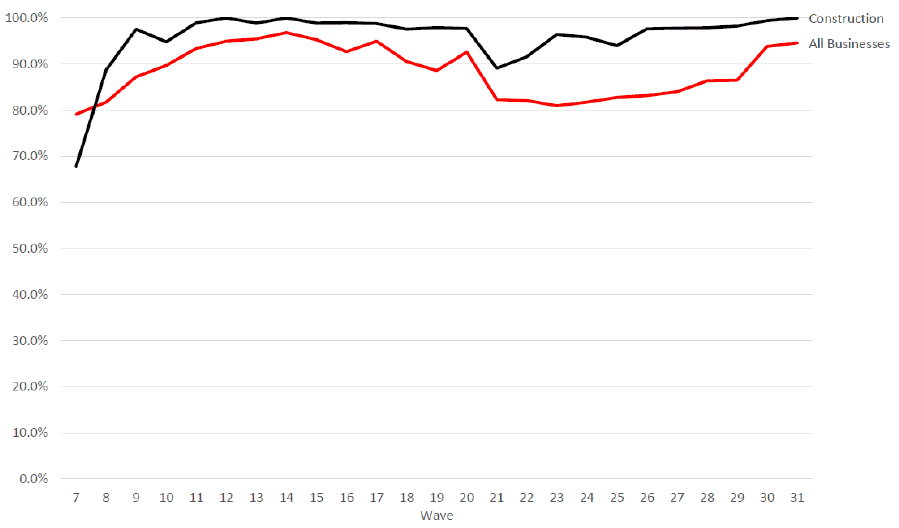

At the height of the pandemic, many construction businesses in Scotland were unable to trade.

Source: ONS - BICS, Scotland Estimates

In June 2020, when initial lockdown measures were still in place, 68% of construction firms with a presence in Scotland were trading, below the average for all sectors (79%). This was the lowest point of activity for the construction sector as relaxation of restrictions commenced. As a result businesses in the construction sector were more likely to continue to trade across all waves of the survey compared to all businesses in Scotland. Almost all (99.4%) of construction firms surveyed were trading in the most recent wave (29th December 2021 to 9th January 2022) of the survey.

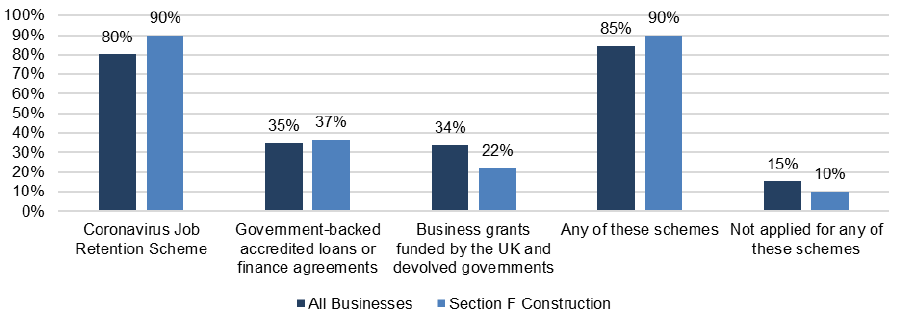

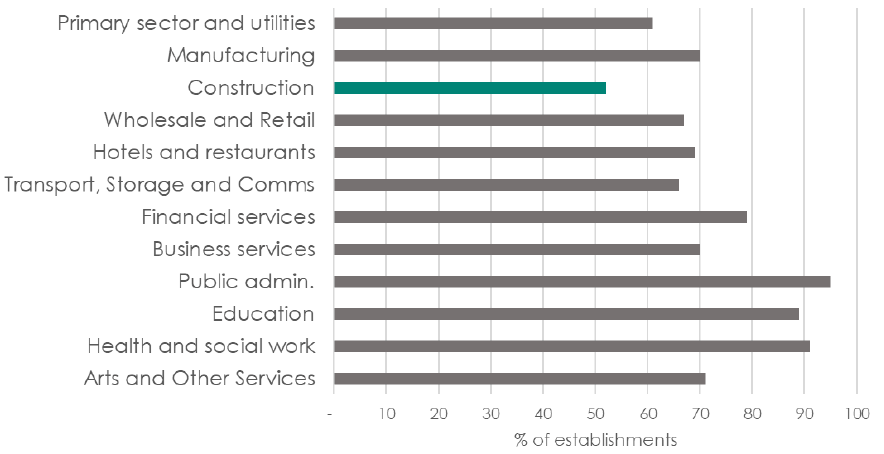

Chart 5 shows that at Wave 16 (covering the period 19 October to 01 November 2020), most (90%) businesses in the construction sector had applied to the Coronavirus Job Retention Scheme (CJRS), higher than the average for all sectors (80%). 22% of construction firms applied to business grants funded by the UK and devolved governments, below the average for all sectors (34%).

Source: ONS - BICS, Scotland Estimates (Wave 16)

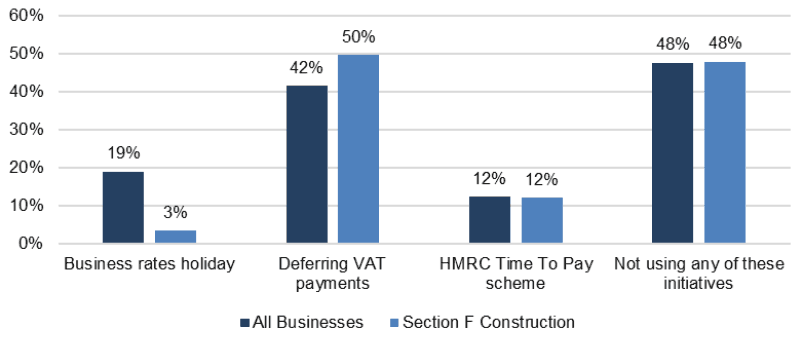

As Chart 6 highlights, 50% of construction businesses deferred VAT payments compared to 42% of all businesses with a presence in Scotland. Fewer construction firms than average benefited from the business rates holiday initiative.

Source: ONS BICS, Scotland Estimates (Wave 16)

Generally, the construction industry felt severe impacts at the onset of the pandemic; however, since easing of restrictions in Summer 2020 it has recovered to a greater degree than many of the worst affected industries. More recent restrictions have not impacted the industry to the same degree as in, for example, accommodation and Food, or Arts, Entertainment and Recreation. Nonetheless, the COVID-19 pandemic has exposed a range of challenges facing the industry. Health and safety concerns, support for apprenticeships and early career entrants and shortages around skills, labour supply and building materials are creating ongoing pressures.

1.2 Previous Reviews and Inquiries in Scotland

There have been three major inquiries into the construction industry in Scotland in the last 10 years. These are: an inquiry led by Robin Crawford into public sector procurement[43] for the Scottish Government which reported in October 2013; an inquiry by the Economy, Energy and Fair Work Committee of the Scottish Parliament[44] in 2019 which considered the future of the construction industry; and a Report of the Review Panel on Building Standards Compliance and Enforcement led by Professor John Cole[45] which was made in June 2018. Additionally, there was an earlier inquiry by Professor Cole into the construction of Edinburgh schools which reported in 2017.[46]

These key reports have all sought to examine specific issues within the industry and, while each has taken a different focus, there are a range of complementary themes and recommendations including those on procurement, leadership building standards and diversity within the industry. Yet progress on these agendas has been limited, and many of the issues dealt with in these earlier reports remain ongoing concerns.

The 2013 Crawford Review on public sector procurement made a range of recommendations on how procurement could be improved including calling for a post of ‘Chief Construction Advisor’ who would champion a public procurement reform process, work with industry and the public sector and act as a conduit between industry and ministers.[47] In addition, the Crawford Review also made a series of recommendations around procurement, community benefit clauses and late payment and identified several issues for the industry itself to consider including around ‘suicide bidding’, supporting shared apprentices and wider training and embracing new technologies and modern methods of construction.

The Scottish Parliament Economy, Energy and Fair Work Committee’s 2019 Inquiry considered the progress made in the industry following the Crawford Review and ongoing issues that would need to be addressed in order to support the future of the industry. The inquiry was wide-ranging and considered issues from access to finance, to procurement, to skills development and career pathways, to infrastructure and land management. The inquiry made a range of detailed recommendations including restating the need for a ‘Chief Construction Advisor’ and ultimately concluded that better leadership in the industry was important for making progress across the range of issues identified.

‘There are long-standing challenges within the industry and these have been highlighted by the Committee. We believe it is time for industry to embed best practice and take ownership for driving change. We have heard that there is innovative work being undertaken around off-site manufacture and new skills frameworks, but industry-wide more leadership is needed on collaboration and coordination. Without such leadership, enduring challenges around procurement, access to finance, innovation and the sector’s cultural image continue to act as barriers to progress.’[48]

The 2017 Cole Report looked at the construction of Edinburgh schools, in light of the collapse at Oxgangs primary school. The report made a range of detailed recommendations for a variety of actors but it also made explicit links between construction failings and the absence of fair work practices. This report noted:

‘Another issue raised in discussion about the quality assurance of sub-contractors was the influence of the way in which individual bricklayers were paid. It has become commonplace over recent years, with the increasing demise of bricklayers being permanent employees of main contractors, that payment is on the basis of the number of bricks laid or square metres of wall completed in a day. The bricklayer is not normally paid anything extra for the incorporation of wall ties, corner ties, bed joint reinforcement or head restraints. The more complicated and numerous the accessories to be fitted the longer it takes and the less bricks are laid, reducing the earnings for that day.’ [49]

The Cole Report went on to recommend:

‘The Inquiry is of the view that, given the widespread nature of similar defective construction across the 17 PPP1 projects, undertaken by bricklayers from different sub-contracting companies, and from different squads within these companies, there is clear evidence of a problem in ensuring the appropriate quality in this fundamental area of construction. It is therefore recommended that the construction industry should re-examine its approach to recruitment, training, selection and appointment of brick-laying subcontractors, means of remuneration, vetting of qualifications and competence, supervision and quality assurance of bricklayers.’

The Review Panel on Compliance and Enforcement undertook a further inquiry into building standards in 2018 in light of significant numbers of newly constructed public buildings in Scotland having defects in the construction of masonry walls and fire stopping. This was complemented by a second inquiry at the same time led by Dr Paul Stollard on fire safety in light of the tragedy in Grenfell Tower. The Review Panel on Compliance and Enforcement in Scotland concluded that greater emphasis needed to be placed in building standards systems on the verification of practice rather than solely the design of new buildings. The review ultimately concluded that:

‘There is a need for a culture change within the Building Standards system, which requires both verifiers and applicants to fully understand and deliver on their responsibilities. Culture change can be achieved through education and training of individuals that enables them to do their work effectively, but it is also necessary to have corporate commitment to change. A common goal of compliance with the Building Standards should be a requisite of any project.’[50]

From these reports and inquiries a picture emerges of a range of long-standing concerns within the industry around procurement, late payment, access to finance, perceptions of the construction industry, health and safety and building standards.

Concerns around fair work are deeply bound with the challenges identified in these earlier reports and inquiries and by taking a fair work approach it is possible to make progress on the range of long-standing issues in the industry. The subject of industry leadership and the need for culture change was raised to a greater or lesser degree in each of these reports and was considered throughout this Inquiry.

It should be noted that both Construction Scotland and the Construction Leadership Council in the UK have recognised the need for change in the industry. Construction Scotland developed an industry strategy from 2019-22 and in response to the pandemic the Construction Leadership Forum developed a Recovery Plan incorporating actions from the Construction Scotland strategy including actions around fair work.

The Construction Leadership Council’s Report into Future Skills of the Industry in the UK recognises the relationship between realising the future ambitions of the industry and the need for fair work and higher levels of direct employment. It calls for, ‘clients to agree to a code of employment where those who contribute to a project are directly employed, thereby ensuring that it is in the employer’s best interest to train their staff and benefit from their improved productivity’.[51]

It also goes on to acknowledge the urgency with which change is needed.

‘The mandate for change for the UK construction sector is clear, with the industry facing an acknowledged skills crisis, a shortage of traditional trades, and an unfavourable demographic profile, (with circa 30% of the UK construction contracting workforce estimated to retire in the next decade), making the current labour-intensive traditional business model unsustainable.’

This Inquiry builds on these earlier reports by considering fair work issues and the perspective of the workforce, along with levers for change within the industry.

1.3 Fair Work in the Construction Industry

In January 2020, the Scottish Centre for Employment Research (SCER) and the Fraser of Allander Institute (FAI) at the University of Strathclyde, commissioned by the Scottish Trades Union Congress (STUC), published a research report analysing fair work outcomes across the construction industry. The SCER & FAI report has formed a key piece of evidence for this Inquiry into Construction. The research incorporated industry level analysis and experience at the workplace level through primary and secondary data collection. This research comprised three stages: an evidence review, union focus groups and interviews; and a workforce survey that explored the experience of working in construction. The purpose of the research was to profile the economic contribution of the construction industry to the Scottish economy and identify key sectoral trends; to analyse the employment and work experience of workers; and to review and evaluate fair work in the industry using the Fair Work Framework.[52]

While the small sample size and the over-representation of union members within the sample mean that the findings are not wholly representative, the research offers valuable insight into and analysis of the industry. The findings and general trends align with many of the views and experiences of CIIG members and the CIIG noted that the survey took evidence from trades people, a key group who are often difficult to reach. Using the SCER & FAI research alongside other key research reports and reflecting on evidence received throughout this Inquiry, it is possible to paint the following picture of fair work within the construction industry.

1.3.1 Security

Security of employment, work and income are important foundations of a successful life. The construction industry faces a range of issues associated with security including levels of self-employment and other non-standard employment and the transitory and sessional nature of work within the industry.

Security at work in the construction industry in Scotland is therefore limited for a significant minority of workers who face insecure contracts; lower pay; income variation, and; job insecurity, alongside concerns over future employability.[53] The SCER & FAI research identified that the experience of those workers not directly employed is commonly worse, raising concerns as to how any increase in self-employment or other non-standard forms of working, such as agency and umbrella contracts, may further reduce fair work in the industry. This research also indicated some deteriorating experiences for directly employed workers.

Agency Work and Umbrella Companies

There is a high reliance on agency work within the construction industry. These workers support construction companies to manage spikes in work, late changes in contract scope, weather slippages, and holiday and sickness cover. Agency workers are an important part of the labour force and quality of agency employers is increasingly relevant to the overall fair work picture. At present, relevant survey data sample sizes are not sufficient to provide robust estimates of agency work.

The use of umbrella companies also known as payroll companies, is related to agency work and has expanded within construction in recent years driven primarily by changes in protections for agency workers and changes to tax law. It is difficult to quantify the scale of the use of umbrella companies as they do not appear as a distinct organisational grouping in official statistics and workers who work through umbrella companies are considered either directly employed as they are employees of the umbrella company or self-employed under the Construction Industry Scheme (CIS).

‘I wait for a text every Friday to say if I will be working the following week. If I book a holiday and go away with my family there's a real chance that my place at work will be taken by another worker and I'll have no work. If I take a day off I might be replaced, if I call in sick I might be replaced, if I don't work every shift I'm offered, no matter how short noticed, I might be replaced.

I pay an umbrella company up to £100 a week to get my own wages. I have no holiday pay, no sick pay, no unpaid holiday pay. I can't work anywhere else if there's no work for a few weeks. In the rail industry I can only have 1 sponsor. My 'holiday pay' is actually a % of my net income that's taken off, then when I get it back it's at gross, so is taxed twice. I also pay both employers and employees NI contributions.’

Unite member describing working for an umbrella company

Source: Unite the Union

Recent research from the Low Incomes Tax Reform Group of the Chartered Institute of Taxation considered the scale of the use of umbrella companies across the UK and estimated that around 600,000 workers are currently employed using this model and that 50% of all agency workers in the UK are now employed by umbrella companies.[54]

According to Chartered Institute of Taxation umbrella companies became common in the construction industry in 2014 when rules around ‘substitution clauses’ in self-employment contracts were tightened which meant that agencies were no longer able to avoid PAYE obligations for workers on construction sites who had previously been deemed ‘self-employed agency workers’. As a consequence of this change many agency workers in the construction sector found themselves transferred as a mass to umbrella companies as their agency did not run PAYE systems.

Many umbrella companies now offer both PAYE and CIS systems for workers in the construction industry.[55]

While the worker is an employee of the umbrella company, the umbrella company does not offer them any work. The role of finding work either falls to the individual worker or to an agency. The umbrella company will be paid by the client or the agency the ‘umbrella company rate’ which allows them to pay the worker their gross pay rate while also covering the employers’ national insurance contributions, holiday pay, auto enrolment costs, the apprenticeship levy (where this applies) and the umbrella company’s margin (which averages £5-£15 per worker per week but can be much higher).[56]

Many issues arising from the umbrella company model are related to the setting or communication of the ‘umbrella company rate’. At times workers believe the advertised ‘umbrella rate’ will be their rate of pay and then feel exploited by the level of reductions that are subsequently made to this rate.

In April 2020 it became a legal requirement for all umbrella companies to provide Key Information Documents that clearly set out all deductions and their impact on take home pay but the TUC notes that a large proportion of umbrella company employees do not receive these documents.[57] There are also examples of the ‘agency rate’ and the ‘umbrella rate’ being identical, raising questions around the legitimacy of deductions to the workers’ pay slip. HMRC rules are clear that the worker cannot face deductions from their gross pay in order to cover the employer’s National Insurance contributions.[58]

Agencies can direct workers towards an umbrella company but they cannot oblige workers to agree to work for the umbrella company. In practice, however, the element of choice within the system may be limited for the worker and they may feel obliged to accept employment from the umbrella company in order to access work. Workers may also need to change between different umbrella companies as opportunities for work arise with different agencies, reducing in practice the stability in employment that this approach appears to offer.

Unions involved in the Inquiry highlighted concerns that workers in agencies or umbrella companies were often unable to access holiday or sick pay, at times this was associated with a fear of losing work while for others it was associated with limited support for longer term illnesses which led to dismissal for the worker even after long service. Unions also noted that agency and umbrella workers were less likely to receive collectively bargained rates of pay.

This aligns with evidence from a recent report from the TUC that considered the role of umbrella companies and highlighted the following concerns.

- Umbrella companies cause a multitude of problems for workers, ranging from confusion and misunderstanding about who the worker’s employer is, to unwittingly embroiling workers in tax avoidance schemes.

- There is a lack of effective regulation in the sector. There are a few voluntary regulatory umbrella associations but there is no independent, regulatory authority setting, monitoring or enforcing standards.

- Potential benefits for workers are largely theoretical. Despite many workers being employees of the umbrella company, they didn’t experience any of the ‘employee’ entitlements such as maternity leave and pay, redundancy pay, unfair dismissal protections and pay between assignments. [59]

The Inquiry noted that many construction businesses have policies in place to avoid their use, recognising the specific harms they can cause workers.

Self-Employment

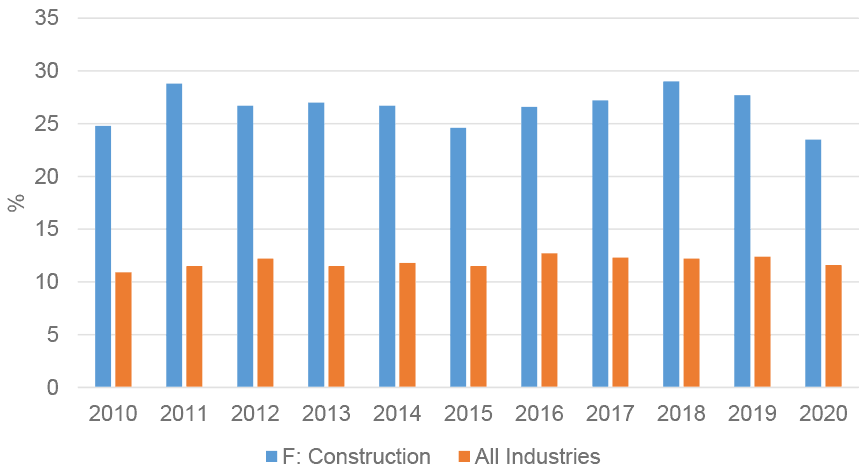

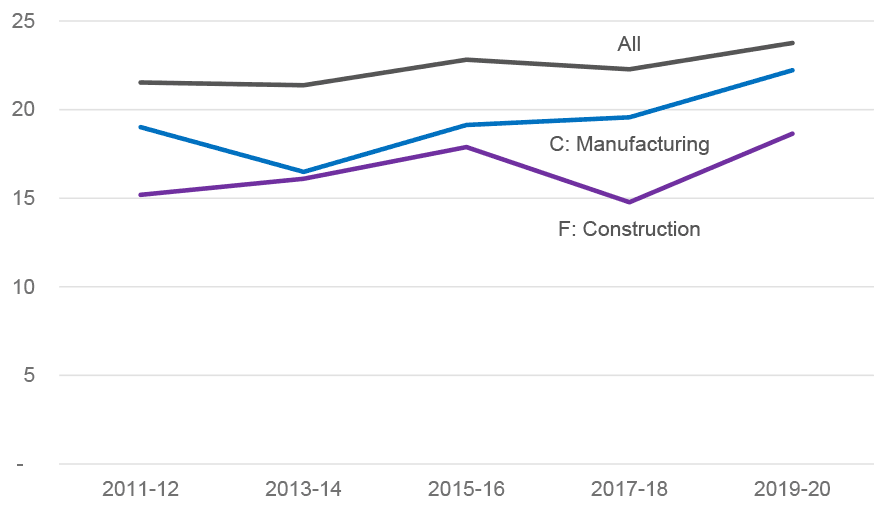

Self-employment plays a significant role in construction. As shown in Chart 7, self-employment now accounts for more than 23.5% of the construction workforce in Scotland, but this is the lowest level of self-employment recorded in the industry in the last ten years, with self-employment more typically sitting between 25%-29%.[60]

Source: ONS, Annual Population Survey, Jan-Dec datasets

Employment status in the Labour Force Survey, and therefore also in the Annual Population Survey[61], is self-reported, with respondents classifying themselves as being either an employee or self-employed. Labour market flow estimates show that the recent increases in the number of employees and decreases in the number of self-employed people have been driven in part, by a movement of people from self-employed to employee status. Of those who move from self-employed to employee status, the number who had changed jobs has only increased slightly from normal levels. Consequently, some of the fall in self-employment comes from an increase in the number of people who have changed to classifying themselves as an employee, even though they have not changed jobs.[62] To summarise: levels of self-employment have fallen from pre-pandemic levels, but these changes have been in part attributed to instances of self-employed people reporting that they are employees in order to access the Coronavirus Job Retention Scheme (CJRS) - which is affecting the continuity of the data.

There have been concerns for many years over ‘bogus self-employment’ in construction. This practice involves workers being incorrectly designated as ‘self-employed’, often to save money for major contractors in terms of tax and employment costs. It is made possible by the structure of UK employment law and widespread confusion amongst workers – and at times employers – regarding employment status, with many wrongly believing that self-employment can be designated by the employer or chosen by the worker rather than being a legally defined description of the employment relationship.

The key driver of bogus self-employment is tax law which reduces tax liabilities for both the employer and the worker. A self-employed worker also has no access to employment rights, like payment of the National Minimum Wage, access to sick-pay or annual leave. The Review of Modern Working Practices by Matthew Taylor recognised this issue and made recommendations to the UK Government on the need to support better understanding of employment status and to make the taxation of labour more consistent across employment forms while at the same time improving the rights and entitlements of self-employed people.[63]

The Construction Industry Scheme (CIS) was originally devised by HMRC in the early 1970s as a reaction to tax being lost from self-employed workers in construction.[64] Under the Construction Industry Scheme (CIS), contractors deduct money from a subcontractor’s payments and pass it to HMRC. The deductions count as advance payments towards the subcontractor’s tax and National Insurance.[65]

While the CIS supports HMRC to recover greater levels of tax revenue from the construction industry it does not deal with the issue of bogus self-employment, and may at times confuse the employment relationship further with self-employed workers under CIS receiving ‘pay slips’ noting the ‘employer’s tax reference’ from the contractor and receiving some tax deductions at source.[66] Confusion around self-employment was exposed during the COVID-19 crisis with reports of workers in construction unaware that they were self-employed until they were unable to be furloughed.

Zero Hours Contracts

The use of zero hour contracts is limited in construction with latest official statistics for July-September 2021 suggesting that 0.9% of the UK’s construction workforce are on zero hours contracts, compared to 3.1% across all sectors[67]. However, many umbrella company workers effectively find themselves on zero hour or very short hour contracts with no obligation on their employer, the umbrella company, to provide them with work.

Pay

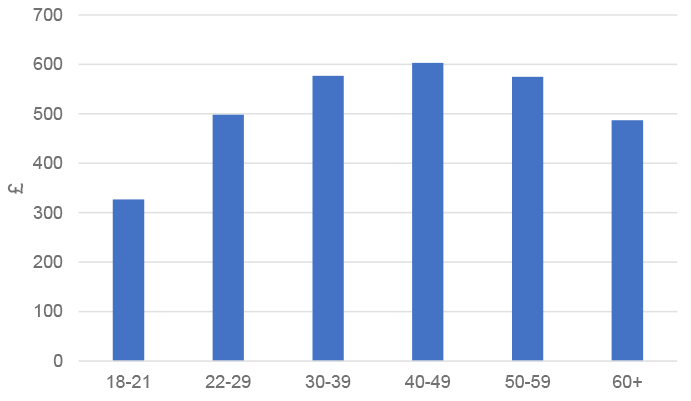

Median pay for full-time employees in the construction industry is £29,055, compared to £26,007 across all sectors[68] - one of the positive areas for the industry in fair work terms. As Chart 8 notes, however, pay rates for young workers in the industry can be quite low, with average apprenticeship wages in construction below the Real Living Wage (RLW).[69] 92% of employees aged 18 or more in the construction industry in Scotland were estimated to be earning at least the RLW (£9.50 per hour) in 2021, compared to 85.6% across all sectors.[70]

Intelligence from unions suggests that low-skilled labourers, umbrella and agency workers, along with apprentices are the employees most likely to earn below the RLW. It should also be noted that full-time working of 35 hours predominates in the industry and levels of part-time work and underemployment have been comparatively low.

‘Pay rates with my employer are not the best. Was clearing more money 10 years ago. Morale among workers is low. Bit higher than average hourly rate but no bonus, travelling time and time and a half only kicks in after 10 hours work instead of 8. Also no paid breaks. All in all shocking’

Worker

Source: SCER & FAI (2020), Facing the future constructively? The experience of work in the construction industry in Scotland

Source: ONS, Annual Survey of Hours and Earnings (ASHE)

The SCER & FAI research noted that there was widespread concern from both workers in the industry and unions of real wage decline over time. Construction workers surveyed were more likely to report difficulties in making ends meet than comparable UK survey respondents. This may in part arise from greater exposure to other expenses/costs (travel, accommodation and subsistence) compared to workers in other sectors.

The SCER & FAI research also found that those respondents not in direct employment (including self-employed workers, agency workers and those working through payroll companies / umbrella companies) were significantly worse off than their directly employed counterparts in a variety of ways. The first related to the nature of their contracts. They faced more contractual variation, shorter tenures, and greater exposure to redundancy or dismissal; they reported greater perceived and possible job insecurity, and were more worried about their own job security. The second related to their earnings. They faced more earnings variation; were less likely to be paid on time; were less likely to have access to sufficient hours of work; were less likely to have sick pay or holiday pay; more likely to feel financially insecure if they became ill; and were less likely to have travel, accommodation and subsistence expenses covered by their employer or contractor. The third related to their perceptions of the industry, specifically that developments in the industry were reducing job security and stability.[71]

Security of work impacts on all other dimensions of fair work. Workers who have secure permanent work are more likely to report greater access to training, have higher levels of safety and be more able to raise concerns, having effective voice on sites.

1.3.2 Opportunity

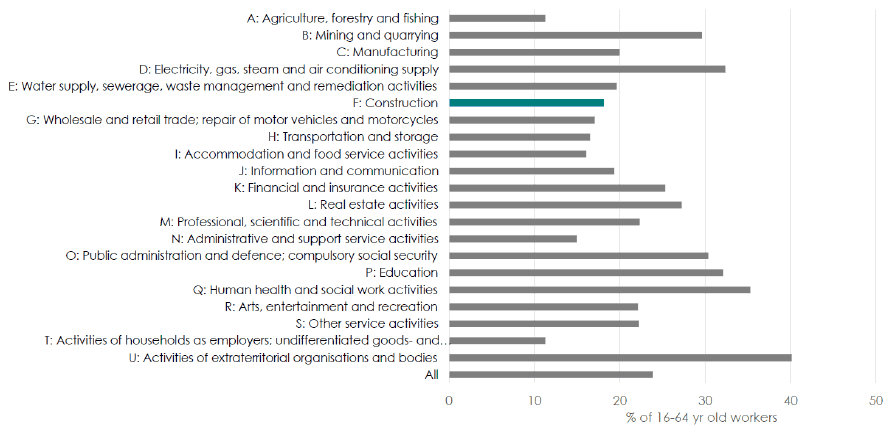

The opportunity dimension of fair work refers to the ability to access and progress in work. The construction industry faces a range of demographic pressures and skills shortages which mean attracting workers to the industry is essential in the coming years. 37.3% of the construction workforce in Scotland is aged 50+, compared to 33.3% across all sectors.[72] Skills Development Scotland (SDS) also estimate that around 50,000 construction workers will retire by 2029.[73] Added to this there are a range of long-standing skills shortages in the industry. The Scottish Building Federation currently report shortages of plumbers, heating engineers, plasterers and other key workers in the industry.[74] Vacancy rates in construction have also risen by 45% on pre-pandemic levels.[75]

Construction is predominantly male-dominated with high levels of occupational segregation. In 2020/21, 84.1% of the workforce in construction were men and 15.9% were women.[76] The gender split in the construction industry has remained largely unchanged since 2009.

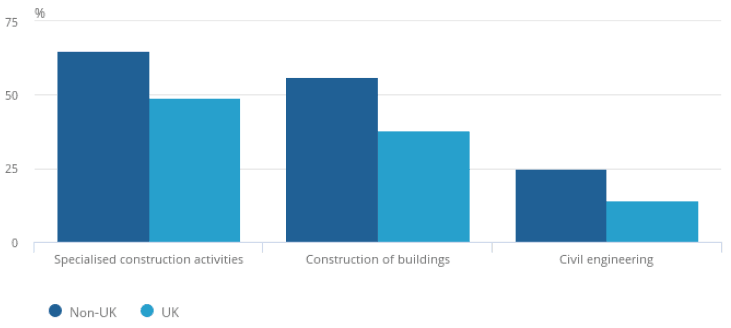

While the proportion of the Scottish workforce who are from a minority ethnic background has been increasing from 3% in 2011 to 4.3% in 2020, those from a minority ethnic background make up only 1.6% of the workforce in the construction industry. 5.9% of workers in the construction industry were non-UK nationals in 2020, compared with 9.2% for Scotland as a whole.[77] In 2018, the ONS carried out analysis of the construction industry between 2014 and 2016 and found that 9,000 workers in Scotland (4% of the industry) were non-UK-born. Of these 39% were EU8-born, 24% were EU15-born (excluding the UK) and 35% were from the rest of the world.[78]

The same study noted that a higher proportion of non-UK nationals in the construction industry (56% or 120,000) across the UK were self-employed when compared with UK nationals (39% or 791,000).

Source: ONS, Annual Population Survey (APS) (three year pooled data set)

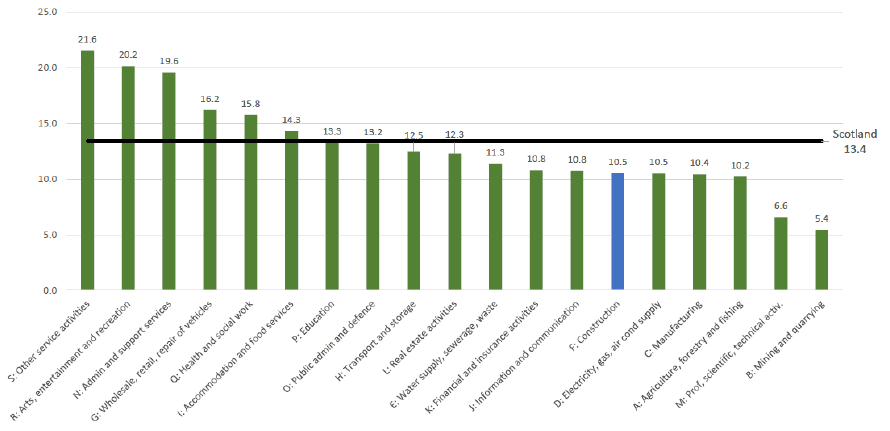

The proportion of workers with a disability in the construction industry (10.5%) is less than the proportion across all sectors (13.4%).[79] There is scope for the construction industry to become more accessible for disabled workers.

Source: ONS, Annual Population Survey (APS)

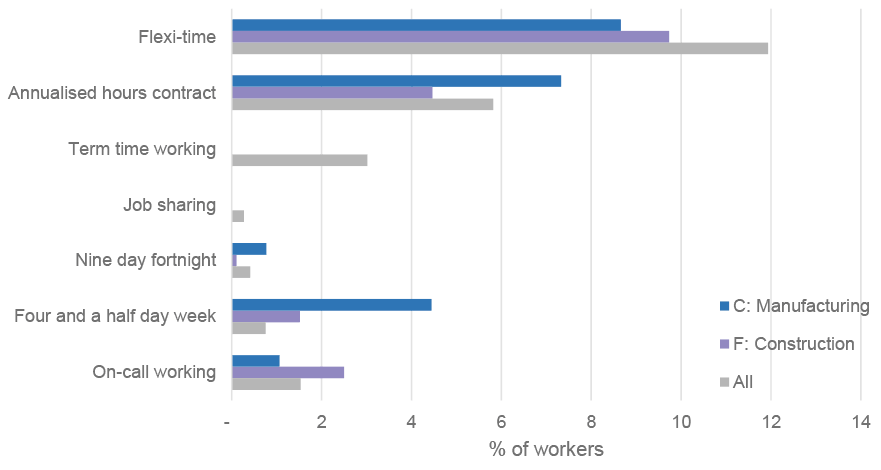

As Chart 11 shows, data around access to flexible working suggests that some flexibility is on offer. However, only 19% of workers report access to any form of flexibility. It should also be noted that this figure includes the use of annualised hours which is a practice that the Fair Work Convention is concerned is open to abuse and can leave the worker with insecure income on a month-by-month basis.

Source: ONS, Labour Force Survey

Source: ONS, Labour Force Survey

The construction industry is in need of workers and increasing diversity of the workforce and supporting effective pathways into and through the industry will be increasingly essential in the next ten years.

1.3.3 Fulfilment

All types of work at every level can be fulfilling where the tasks, work environment and employment conditions taken together are well aligned to the skills, talents and aspirations of the people who carry it out.

There are long-standing and well-recognised issues within construction around skills, skills accreditation and skills shortages. It should be acknowledged that the construction industry is a skilled industry and apprenticeships in Scotland are generally regarded as offering training to a high standard. Despite this there are concerns around deskilling, some of which is linked to the creation of lower-level qualifications to support narrower less skilled job roles, and some of which links to a lack of ongoing professional development and support for the maintenance of skills.

Chart 13 and Chart 14 below show that while 52% of construction employers reported offering training in the previous 12 months (both internal and external training), less than 20% of construction workers report being offered opportunities to train.

‘…very big problem with training. Fourteen years’ experience with one company I have just one training, cost from my own pocket. Lack of control over the fact that companies help employees in their personal development’

Worker

Source: SCER & FAI (2019), The construction industry in Scotland

Source: Scottish Government, Scottish Employer Perspectives Survey

Source: ONS, Annual Population Survey

The SCER & FAI research also notes that workers perceived a lack of progression opportunities within the industry and difficulties accessing training.[80] Equally the use of non-direct contracts limits training and ongoing professional development, with workers on these contracts required to source and pay for their own training and facing a loss of income when attending courses. With 23.5% of the workforce self-employed and many more working through agency or umbrella contracts, the impact of these forms of working on the uptake of any upskilling and reskilling opportunities is potentially significant. Collective agreements can be used to support training in the sector. For example, the NAECI places requirements on employers to ensure employees skills are updated.

To workers in the construction industry, opportunities to advance within their careers and move into senior roles often appear limited to workers within the construction industry. The SCER & FAI research noted that most workers did not have their performance formally appraised at work to support their career development and that while career opportunities into management did exist and supervisory roles, the perception of unions and the workforce was that these opportunities were rare.[81] With an increase in graduate entry to senior roles in construction pathways for advancement for the existing workforce may feel more limited, even where those opportunities exist.

The workforce implications of the transition to net zero means that effective training, upskilling and continued professional development is essential. However, the evidence suggests that opportunities for continued training are becoming increasingly limited for the workforce.

1.3.4 Respect

At its most basic, the respect dimension of fair work involves ensuring the health, safety and wellbeing of everyone. The respect dimension also considers issues around dignity at work and bullying and harassment but also goes beyond this to include dignified treatment, social support and the development of trusting relationships.

‘In my 30 years in construction I have seen lots of changes, mostly positive especially regarding health and safety’

Worker

Source: SCER & FAI (2020), Facing the future constructively? The experience of work in the construction industry in Scotland

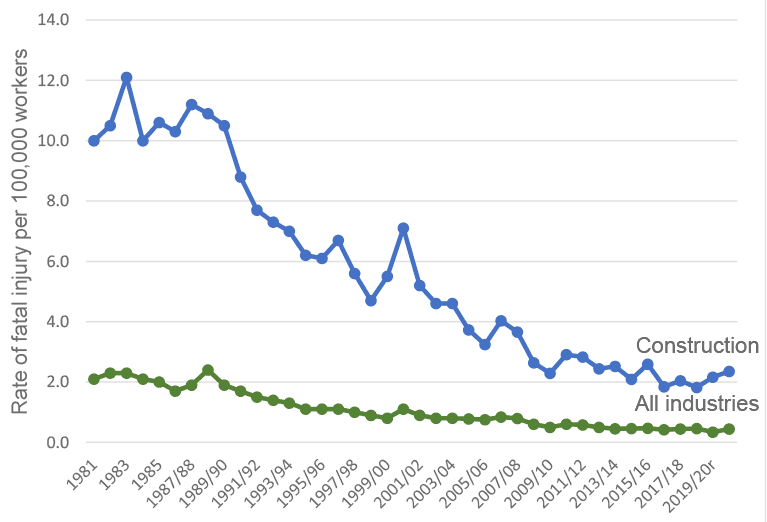

The perception of the construction industry is that the work is relatively strenuous and dangerous; yet health and safety on sites is an area where the construction industry has made significant progress in recent years.

As Chart 15 shows there has been a significant decline in fatal industries within construction. The rate of fatal injury in construction in 2020 was 1.64 per 100,000 workers. This was much lower than agriculture, forestry and fishing (7.73 per 100,000 workers) and water supply (4.18 per 100,000 worker) but it was still four times higher than average across all industries (0.42 per 100,000 workers).[82]

In 2019/20, there were 40 fatal injuries to workers in construction in Great Britain. Over the past five years, on average 47% of deaths were due to falls from height, suggesting that more progress still needs to be made.

Source: RIDDOR, 1981 to 2019/20

The rate of self-reported illness caused or made worse by work (3,520 per 100,000 workers) is similar to the average across all industries (3,400 per 100,000 workers) and has been relatively stable since 2004 (when data collection began). The leading type of self-reported illness in construction in 2019/20 was musculoskeletal disorders, accounting for 47% of all working days lost due to work-related illness.[83]

Despite the progress made there continues to be significant issues of concern within the respect dimension, particularly with regard to bullying and harassment. Respondents to the SCER & FAI research reported high incidents of verbal abuse, bullying and harassment, and humiliating treatment and behaviours compared to wider survey evidence, on the grounds of age, religion and nationality. A large minority reported that employers did not deal with this effectively, and workers subjected to these forms of treatment had a higher intention to quit the industry. Worryingly unions also reported that workers are reluctant to raise any concerns over bullying and harassment as they are fearful that it may affect their employment prospects.

Yet there is also a growing awareness of mental ill-health in the industry much of which is associated with fair work issues and cultures at the workplace. Addressing mental ill-health will require greater attention to eliminating bullying and harassment, and making progress on respect has a fundamental role to play in ensuring that the construction industry is a positive place to work and is seen as a desirable career option.

1.3.5 Effective Voice

Effective voice requires a safe environment where dialogue and challenge are dealt with constructively and where workers views are sought out, listened to and can make a difference. Effective voice underpins the other dimensions of fair work, and trade unions and collective bargaining structures are the strongest route of achieving effective voice.

The Labour Force Survey estimates that unions are present in around a third of workplaces and that 17.6% of employees in construction in Scotland are currently trade union members.[84]

Construction has a range of sectoral agreements that are used to set terms and conditions and to support standards. Collective bargaining agreements in construction are estimated by the Labour Research Department to cover around 85,000 workers or around 62% of the employed workforce.[85]

Many of the agreements have existed for decades and were born out of a need to prevent walk-offs, to provide certainty around costs for large-scale projects and to manage competition for labour due to wage differentials between different sites. They continue to renew themselves being renegotiated on an agreed schedule to meet the changing needs to the industry.

The agreements therefore come from the industry and reflect its particular needs and pressures over time. While the biggest of the agreements the Construction Industry Joint Council (CIJC) appears to be in decline,[86] the structure and potential for collaborative working remains and if effectively supported could play a key role in supporting the industry to meet future challenges and fully embed fair work.

Blacklisting

In 2009 the Information Commissioner discovered a secret blacklist maintained by the Consulting Association, naming over 3,200 construction workers, overwhelmingly trade unionists. The information, built up over decades, was used by 44 of the largest construction employers in the UK to deny employment to those named.[87] These companies made significant financial investment in maintaining and accessing this blacklist and supplied information to keep it updated.

Blacklisting is illegal under a range of statutes, including the European Convention on Human Rights and subsequent anti-blacklisting legislation was passed at both a UK and a Scottish level in the wake of the scandal in construction.

In total construction firms have been forced to pay compensation of around £55 million to more than 1,200 blacklisted workers (when legal costs are included) and £230,000 as a contribution to a fund used to retrain trade unionists.[88]

However, the impact of blacklisting still impacts on relationships within the construction industry. Construction workers continue to report a reluctance to be seen to consult with unions, for fear of blacklisting and the loss of future employment. While progress has been made on the confidence of the workforce to raise health and safety issues, there appears to be a hesitancy to raise other issues on sites like bullying and harassment.

Dealing with the legacy of blacklisting, improving confidence among the workforce and improving relations between unions and employers is a requirement to build better fair work outcomes in the construction industry.

From a fair work perspective there is significant and well-developed infrastructure that supports positive outcomes in the industry including a range of sectoral agreements. These are industry-designed and industry-led and support positive outcomes in the unique context that exists within construction. In many ways these mechanisms were created to take account of the fragmentation of the industry, the nature of seasonal work and the often transitory workforce, and were designed to ensure high skill levels and consistent standards across employers.

1.4 Reflections on the Fair Work Context in Scotland

Compared to other industries, construction is heavily labour-intensive. The industry has long been characterised by insecure work but there has been a greater shift towards non-standard employment practices such as self-employment, agency work and umbrella contracts over recent decades.[89]

Large UK construction firms tend to operate as ‘hollowed-out flexible’ firms and very few employ labour directly. The model that has emerged is for a large number of smaller companies and sole traders to be brought in as sub-contractors, bringing in the necessary skills and experience for each specific contract. Sub-contractors are usually smaller, often specialist, businesses who play a key role in employment and training, providing apprenticeships and routes into the industry.

Agency workers and workers employed by umbrella companies provide additional labour to supplement a declining directly employed workforce. These workers support construction companies to manage spikes in work, late changes in contract scope, weather slippages, and holiday and sickness cover. Agency workers are an important part of the labour force and quality of agency employers is increasingly relevant to the overall fair work picture. Umbrella companies have a relationship with agency work but represent a further lengthening of the employment relationship and deploy a business model that presents specific problems for workers.

Margins in the construction industry are low which, combined with low barriers to entry and issues around late payment, means high numbers of insolvencies and a high level of churn. This can have significant consequences for the health of the supply chain and access to skills. Skills shortages in construction have been rising over recent years. There is an ageing workforce and an increasing need for modernisation around construction methods, yet access to training is reducing as a consequence of the outsourcing of labour.

The industry has long-standing equality issues, with high-levels of horizontal segregation and a low level of access to family friendly or flexible working. The industry lacks diversity in terms of race with only 1.6% of workers in the industry from an ethnic minority background.[90] Non-UK workers are also often concentrated in the more precarious parts of the industry, such as agency work, umbrella contracts or self-employment.

There is also a growing awareness by all stakeholders in the industry that change is needed and that the current labour-intensive, fragmented approach cannot continue, and more modern construction methods, greater diversity within employment and a strong skills pipeline will need to be increased and maintained. There is also a growing acceptance that these outcomes cannot be achieved without greater levels of direct employment, as noted within the recent Construction Leadership Council report.[91] While the organisational landscape is complex and at times fractured, there are a range of key sectoral collective bargaining agreements which are already supporting positive outcomes in the industry which can be built upon to improve the overall picture.

The Inquiry also recognises that a range of practice exists in the industry and that many employers have already taken steps to embed fair work in their businesses. This Inquiry aims to identify areas where fair work can be strengthened, along with positive practice that can be built upon. Ultimately the purpose of the Inquiry is to identify practical and tangible actions that can be taken to support positive outcomes for the workforce. Improving fair work in all parts of the construction supply chain and supporting recruitment retraining and upskilling will be key to delivering positive outcomes for workers and employers in construction and meeting the challenges of coming years.